Managing Tax Exemptions

This tutorial provides step-by-step instructions on how to add, edit, and manage tax exemptions for employees in XandaPay.

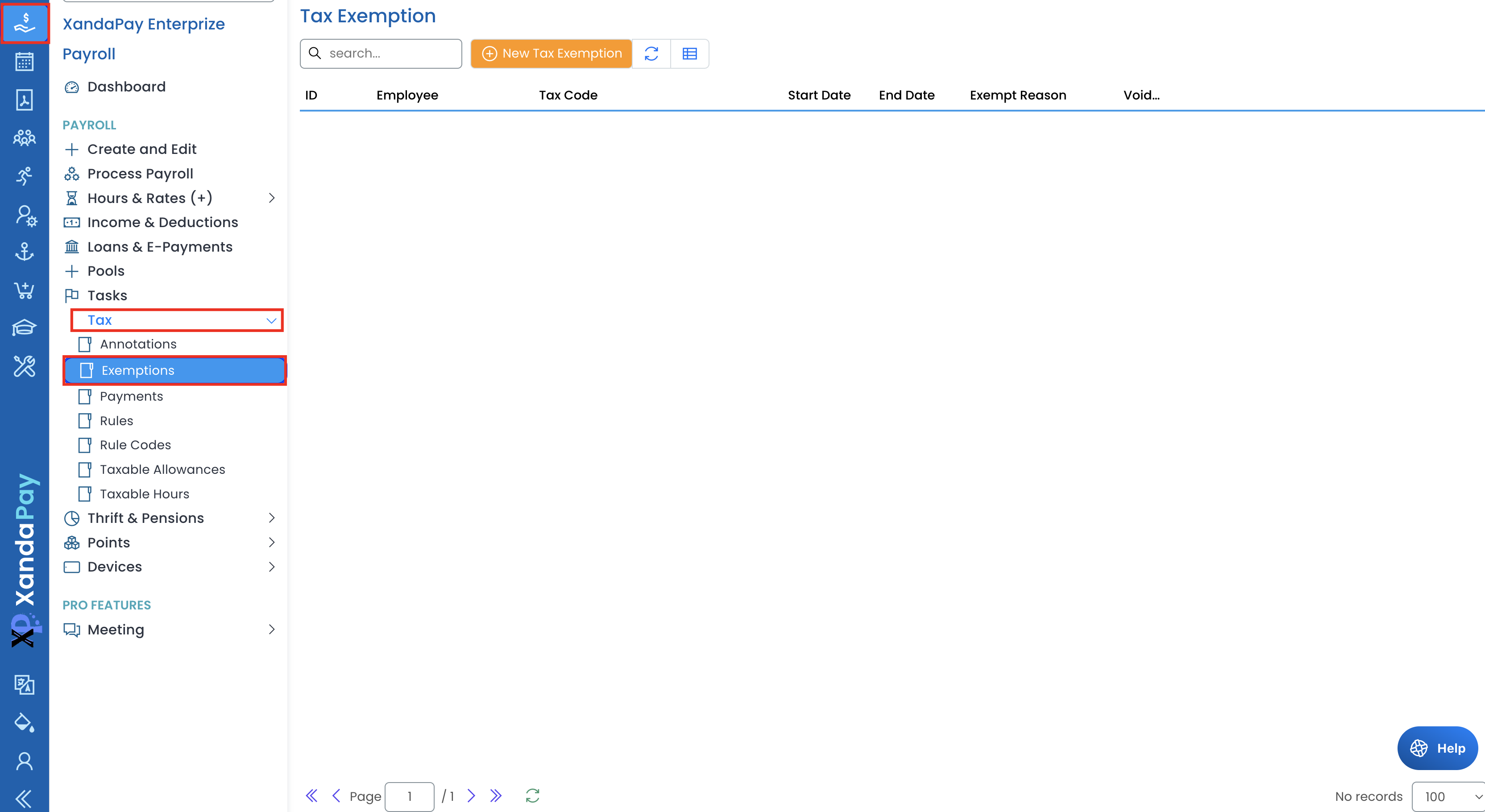

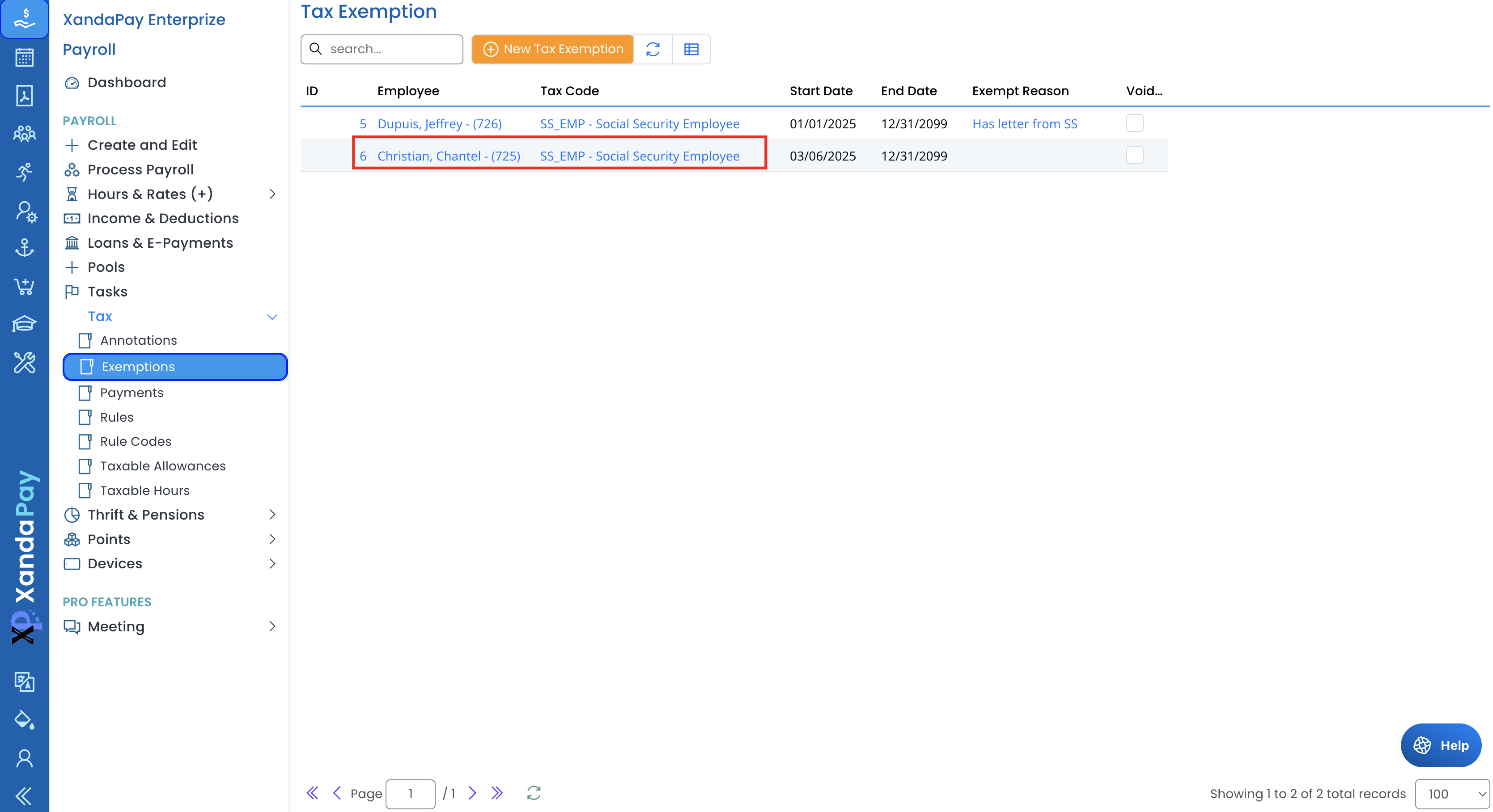

Accessing the Tax Exemptions Module

- Log into XandaPay.

- Navigate to the Payroll section in the left-side menu.

- Click on Tax to expand the options.

- Select Exemptions to open the tax exemption management screen.

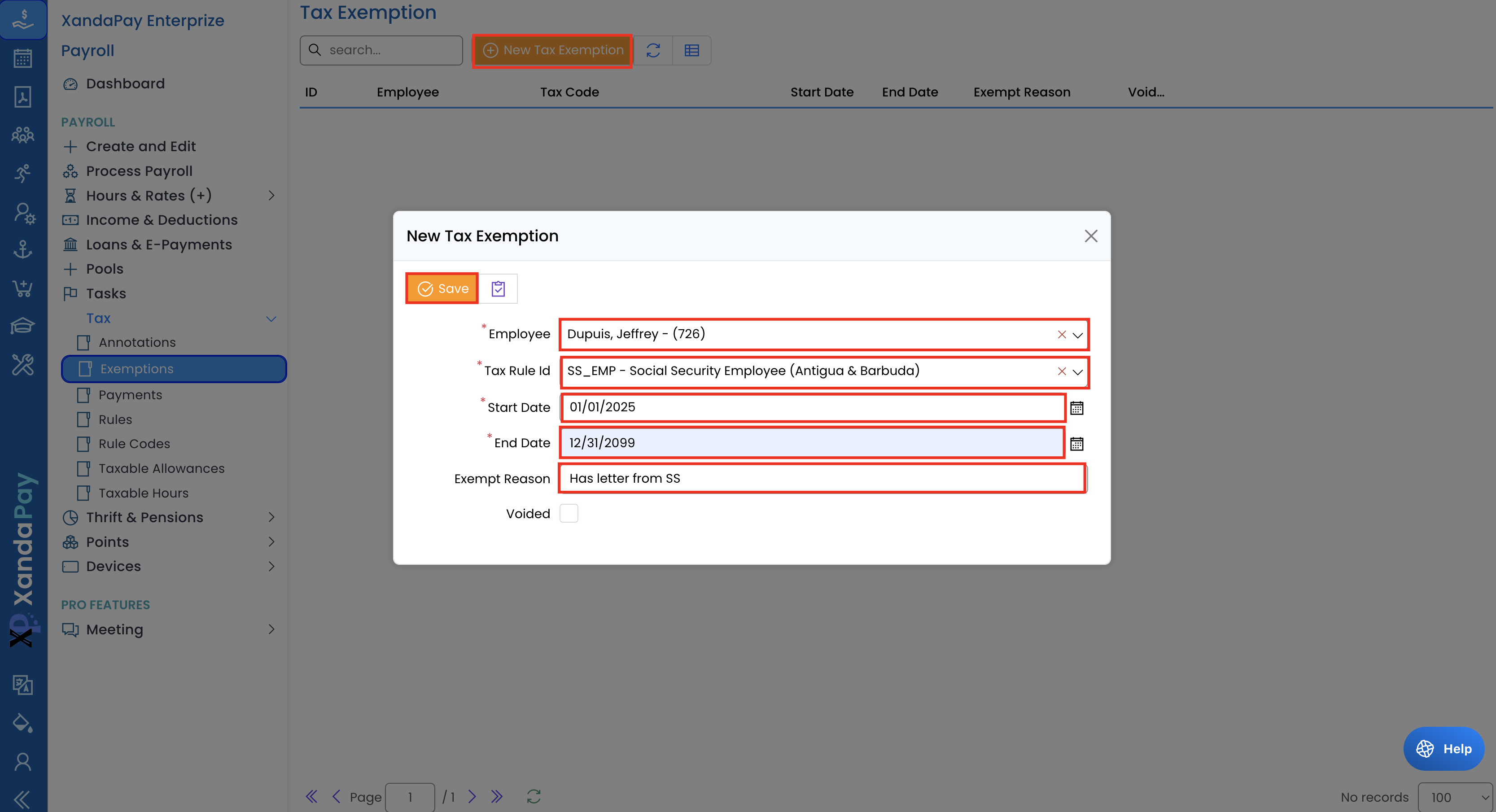

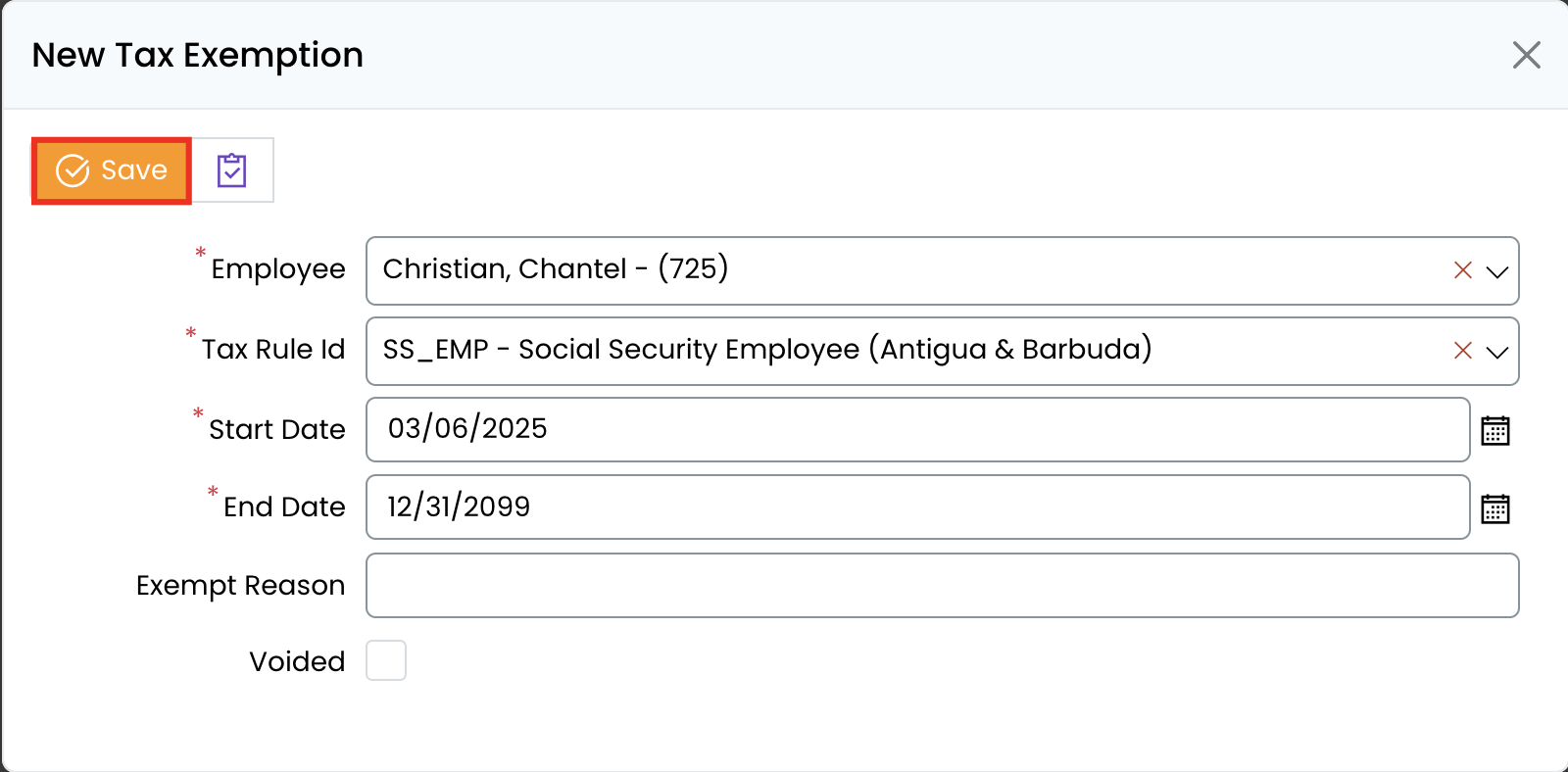

Adding a New Tax Exemption

- Click on the New Tax Exemption button at the top of the screen.

- In the Edit Tax Exemption form:

- Select the Employee from the dropdown list.

- Choose the Tax Rule ID (e.g., Social Security Employee, Social Security Company).

- Enter the Start Date and End Date of the exemption.

- Provide the Exempt Reason (e.g., "Receives pension", "Exempted by Age").

- Click Save to apply the exemption.

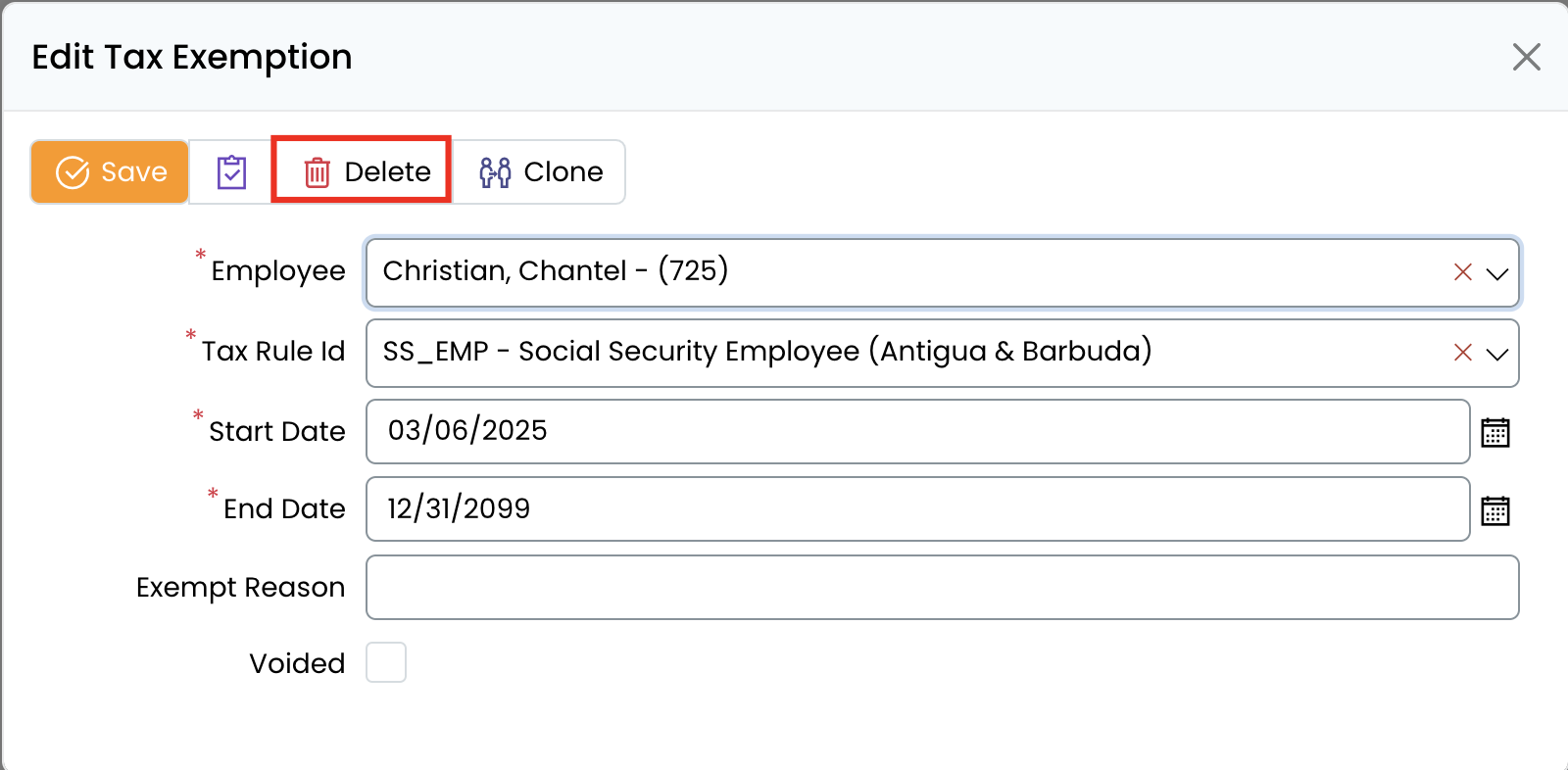

Editing an Existing Tax Exemption

- In the tax exemptions list, find the employee whose exemption you want to edit.

- Click on the linked Tax Code to open the exemption details.

- Make necessary changes to the fields (e.g., update the End Date if the exemption is extended).

- Click Save to confirm the changes.

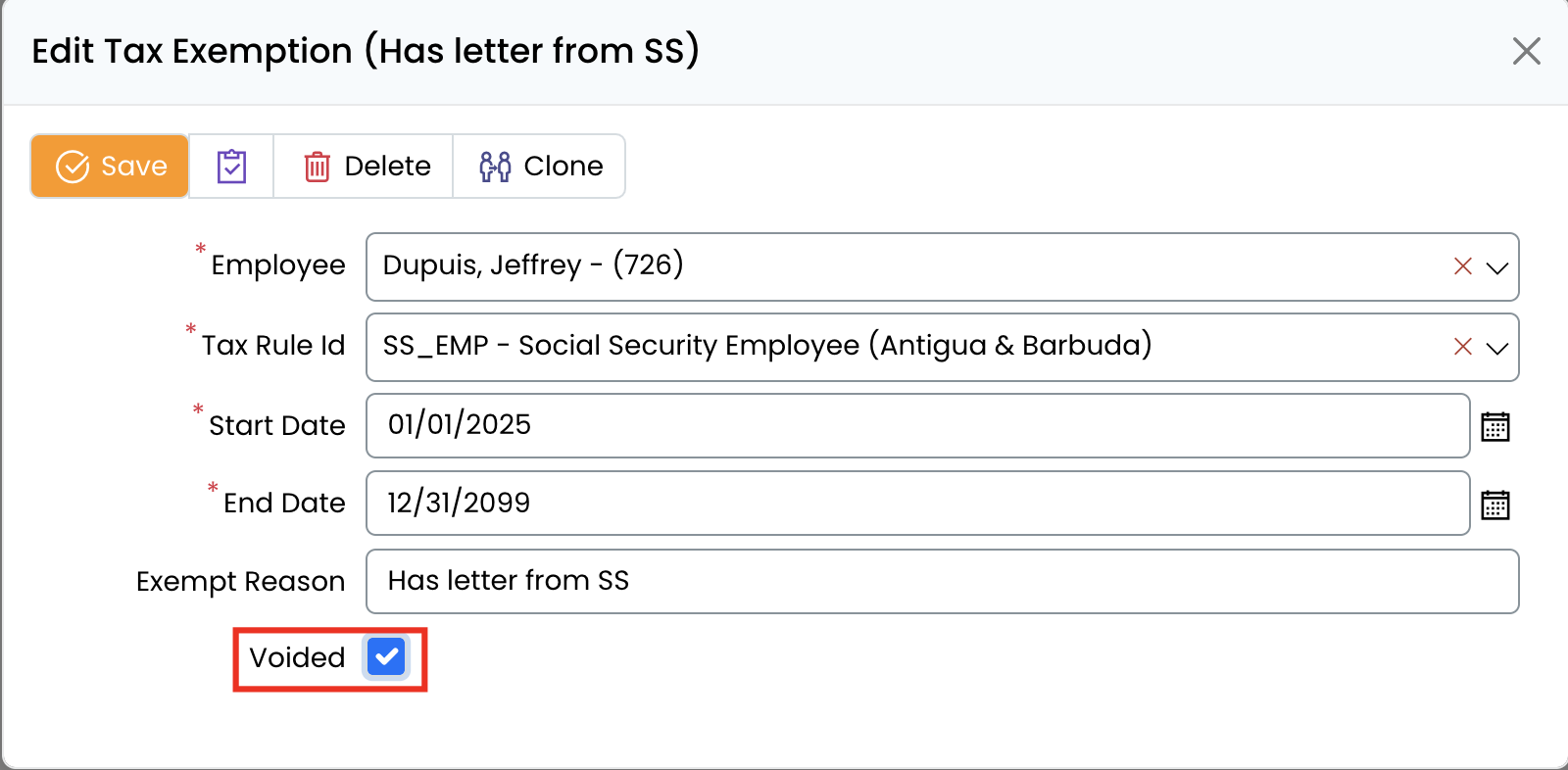

Voiding a Tax Exemption

- Open an existing tax exemption record.

- Check the Voided box if the exemption is no longer applicable.

- Click Save to apply the change.

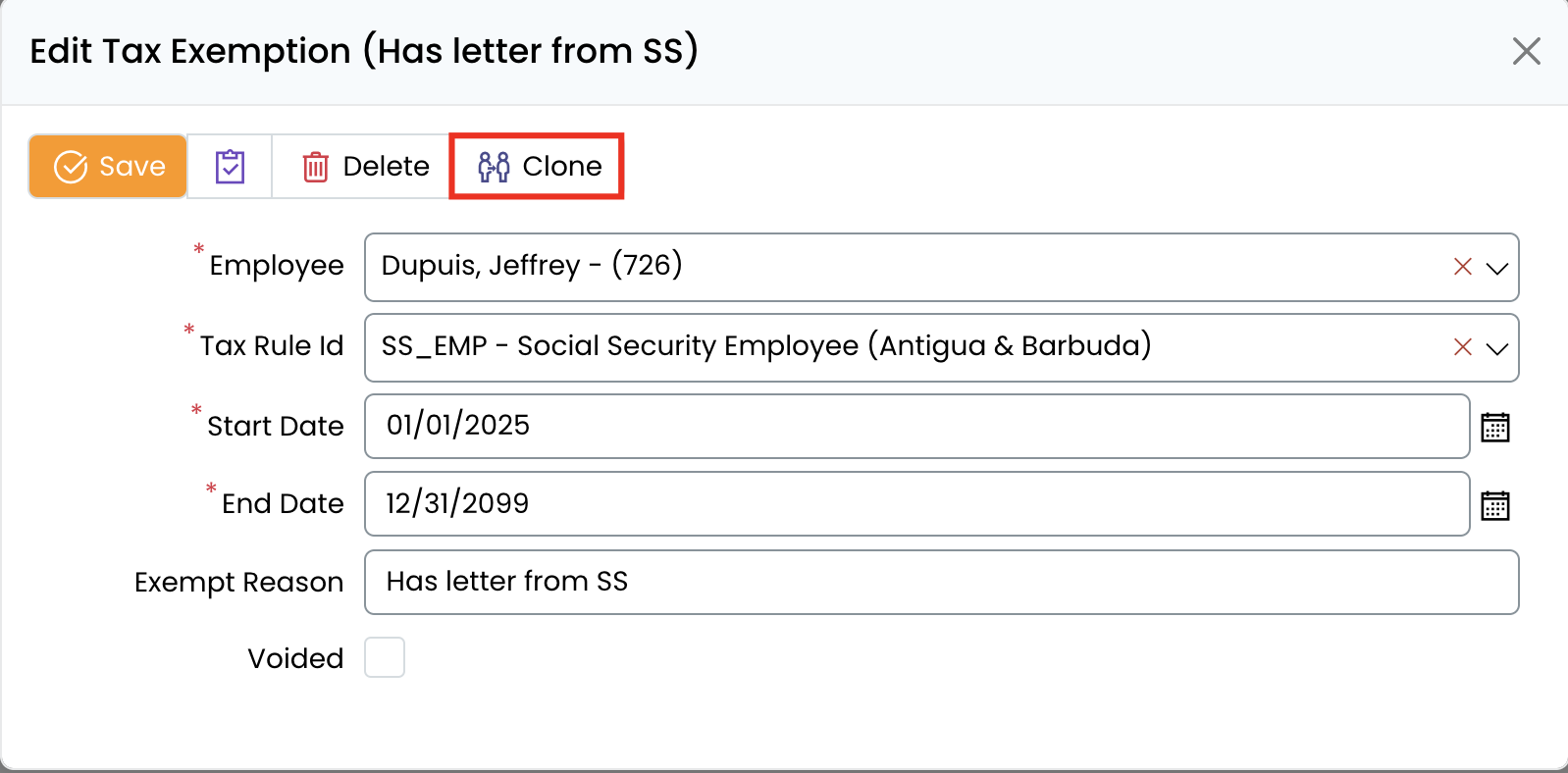

Cloning a Tax Exemption

- Open an existing tax exemption record.

- Click the Clone button to duplicate the exemption details.

- Select a different Employee (if applicable).

- Adjust the Start Date, End Date, and Reason as needed.

- Click Save to confirm the new exemption.

Deleting a Tax Exemption

- Open the exemption you wish to remove.

- Click Delete at the top of the screen.

- Confirm the deletion when prompted.

Key Considerations

- Employees must meet the exemption criteria before being added to the system.

- The Start Date and End Date should align with the company’s tax policies.

- Only authorized personnel can manage tax exemptions.

With these steps, you can efficiently manage employee tax exemptions in XandaPay. 🚀