Managing Tax Annotations

Tax Annotations allow you to adjust employee tax records. These annotations appear on the relevant tax remittance reports.

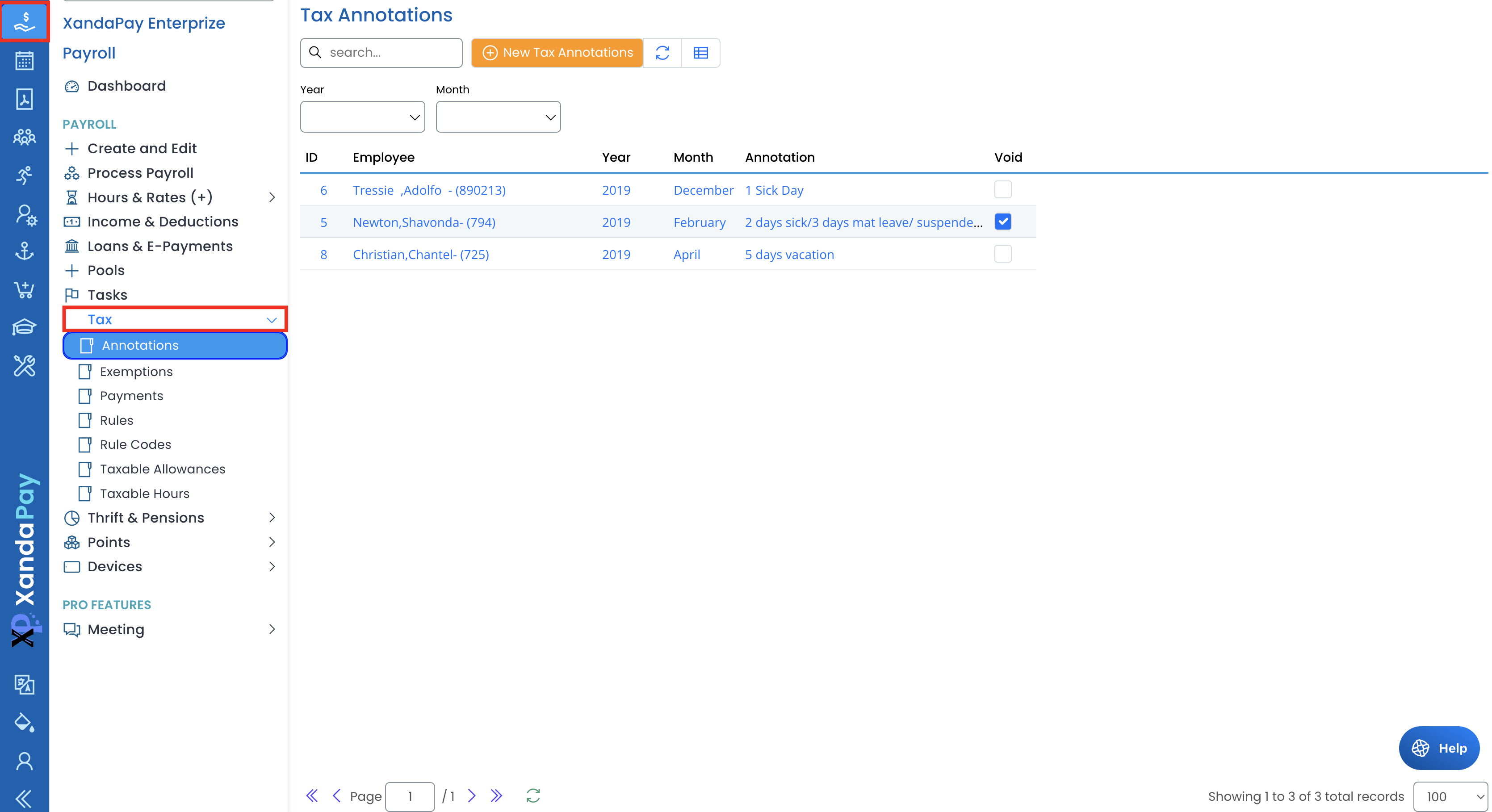

Accessing the Tax Annotations Page

- Log in to XandaPay and navigate to the Payroll module.

- Under Tax, click on Annotations.

- You will see a list of existing annotations for employees, showing the Year, Month, Annotation Amount, and Void Status.

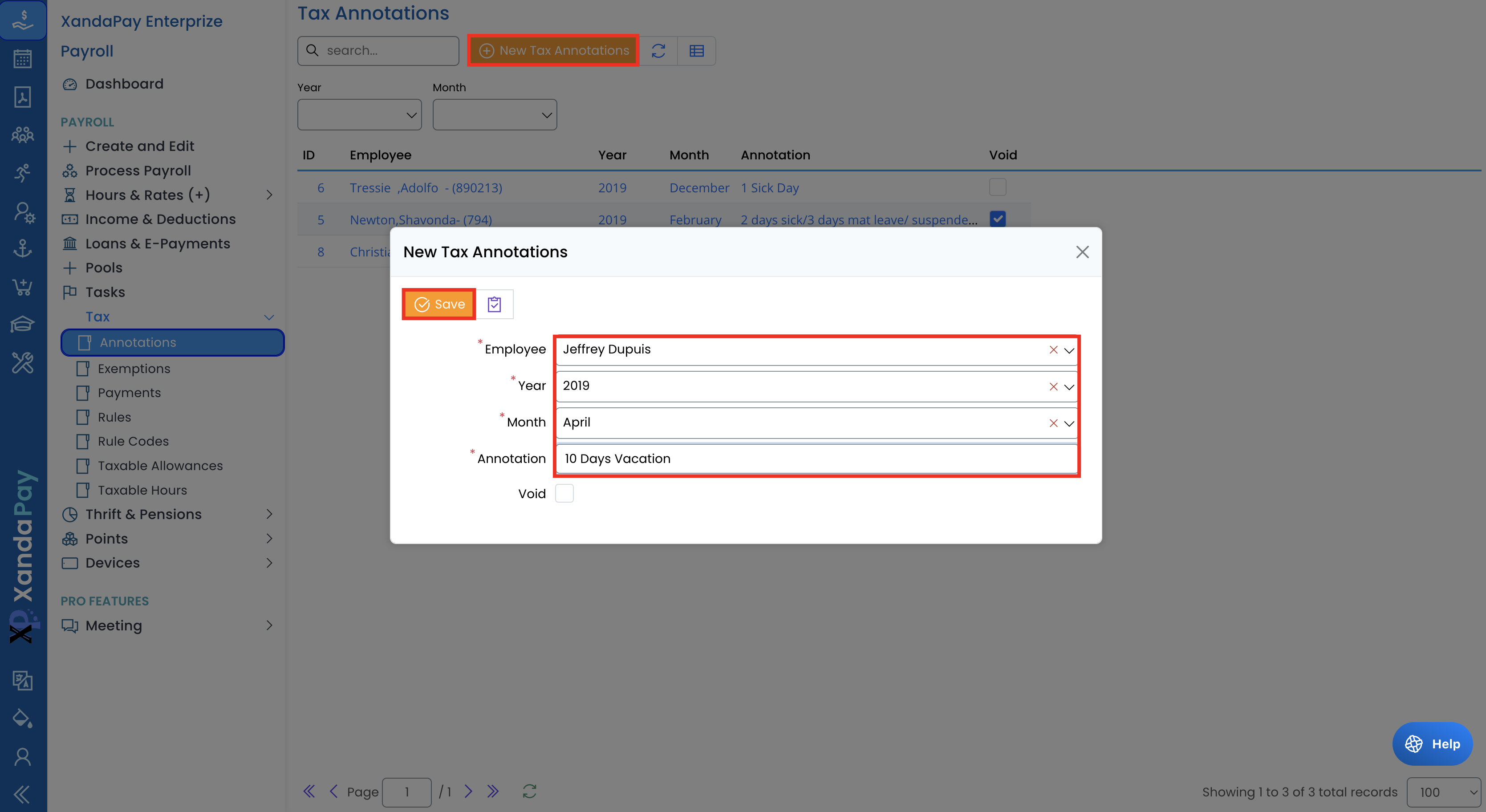

Adding a New Tax Annotation

- Click on New Tax Annotations.

- In the popup form:

- Select Employee: Choose the employee to apply the annotation to.

- Select Year: Pick the tax year for the annotation.

- Select Month: Choose the relevant month for the adjustment.

- Enter Annotation: Input the description (e.g., 5 Vacation Days or 1 Sick Day).

- (Optional) Check "Void" if the annotation is no longer valid.

- Click Save to apply the annotation.

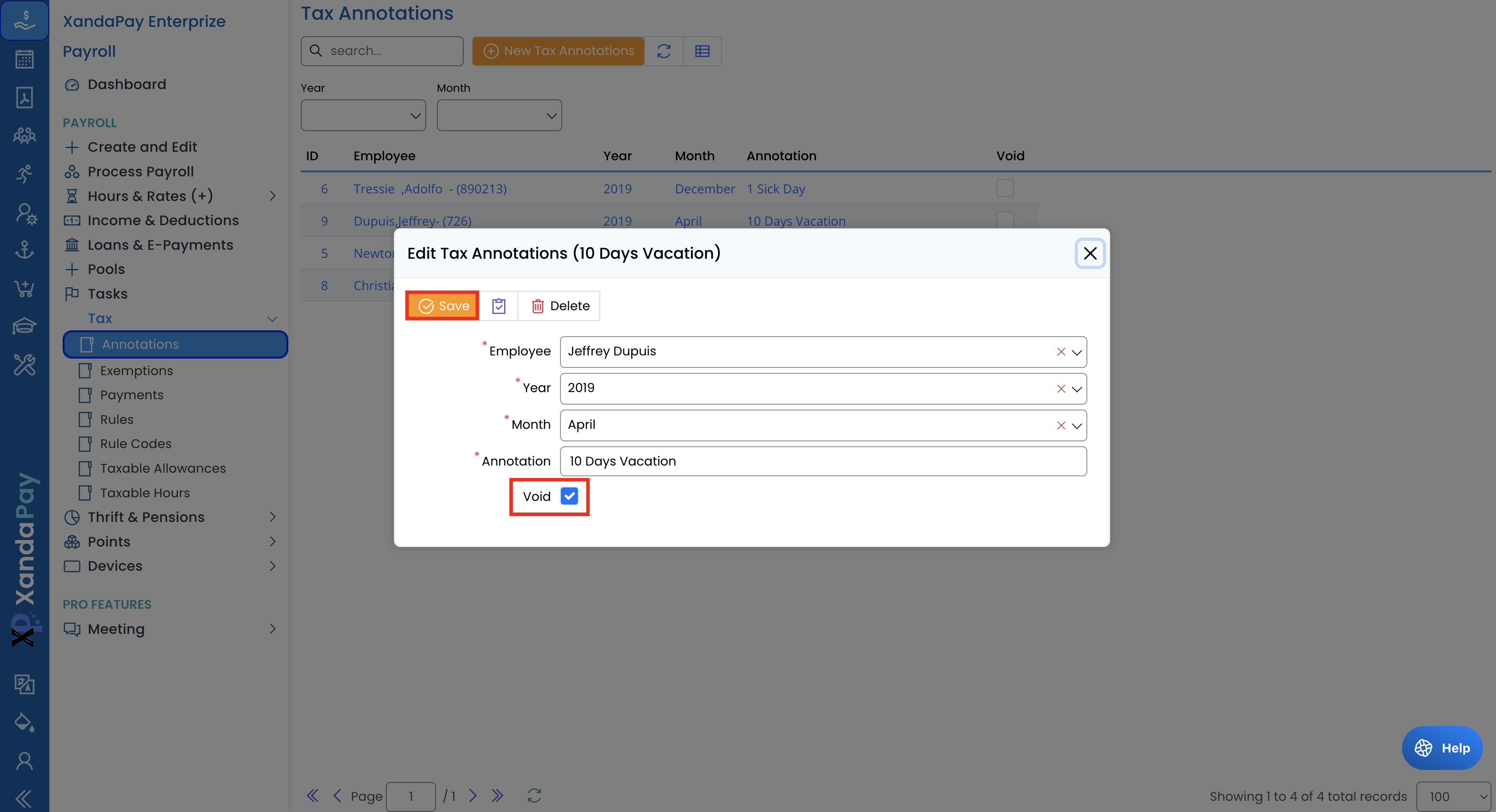

Editing an Existing Tax Annotation

- Locate the annotation in the list and click on the employee’s name.

- In the Tax Annotation dialog:

- Update the Employee, Year, Month, or Annotation Amount as needed.

- To void the annotation, check the Void box.

- Click Save to update the record.

Deleting a Tax Annotation

- Open an annotation by clicking on an employee’s name.

- Click Delete and confirm the action.

⚠ Warning: Deleting tax annotations is a permanent action and cannot be undone.

Important Notes

- Voided annotations will not impact tax remittance reports.

- Ensure the correct month and year are selected, as incorrect entries could affect tax filings.

By following these steps, you can effectively manage employee tax annotations within XandaPay. 🚀